Symmetry Indicators

For The NinjaTrader Platform

Symmetry Indicators For The NinjaTrader Platform

Day Trading Price Action

E-Book

This E-Book is designed to teach you a powerful setup that the top hedge funds, institutions and elite day traders execute in the currency markets and the futures markets. If you trade the S&P500 futures(ES), Nasdaq Futures(NQ), Russell 2000(TF), Dow Futures(YM), Bonds(ZB), Euro(EC or EUR/USD), British Pound(BP or GBP/USD) or any other forex or currencies then this setup is for you.

Over the last 20 years I have mastered this specific setup in the futures and forex markets. This specific price action setup tells me when the big money is entering for a long(Buy) position or shorting(Sell) position in the markets within a few bars. I generously share with all you fellow traders, this trading strategy in a simple format for the veteren 30 year trader and/or the day trader that is just starting out that needs an edge in the markets. This strategy will enable you to trade with a genuine edge in the market and will be a valuable trading setup to use in the currency and futures markets.

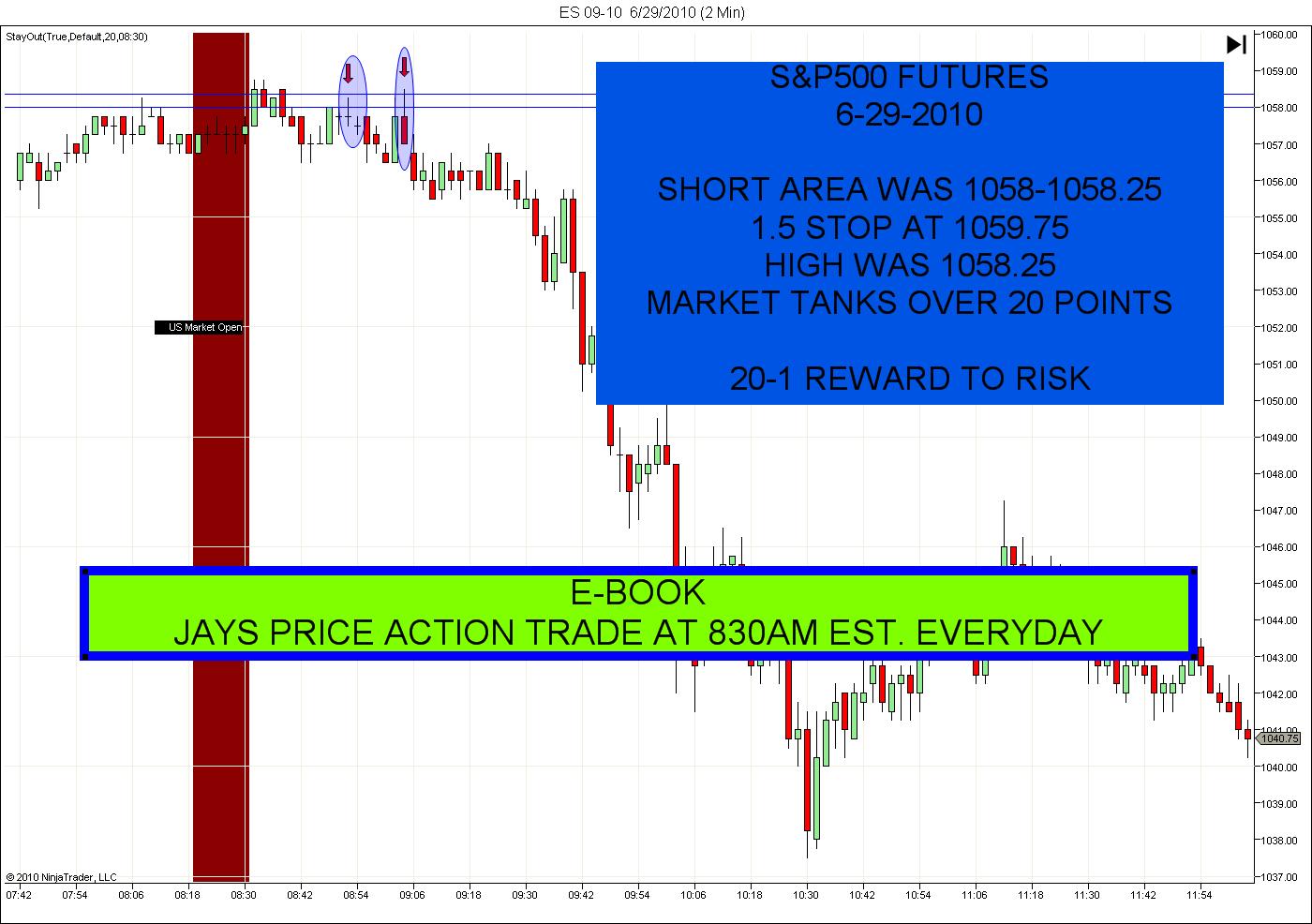

Whats the secret and when do I trade it? The secret is Price Action off of my specific time frame and and trading this setup with major monthly economic news releases! Does this setup work on a daily basis without news. Yes, see the chart of the SP500 futures trade on 6-28-2010. The setup nailed the exact high. I like to use it with all the major monthly economic news releases. It allows me to trade with the push of the hedge funds and institutions just minutes after the news is released. This specific defined setup allows you to enter the market just minutes after the annoucments with a very large average reward to risk. The fact remains, statistics show that news releases can trigger very large movements, leading to the greatest trading opportunities in a short period of time, we believe. The key is to know when to enter the market after the news. My specific setup does that for you. No thinking involved. I have a specific setup that must happen in order to execute the trade. This will tell me when to buy and sell. Mastering economic news report trades takes your day trading to an institutional level and hedge fund level. Using my specific setup you have high probability trades with the release of economic news creating fast profits from the volatile movements after the release. On non news days it enables you to see the overall push minutes after the 8:30am est. open. Most novice traders wait the news out, waiting until the market has made its move thus forcing a low probability trade and when the market is ready to counter or go into chop mode. This is why the hedge funds and institutions will always have the edge over the public.

www.SymmetryIndicators.com

Copyright © 2010 SymmetryIndicators - All Rights Reserved

*Risk Disclosure / Risk Disclaimer:

There is a risk of loss in futures, Forex and options trading. There is risk of loss trading futures, Forex and options online. Please trade with capital you can afford to lose. Past performance is not necessarily indicative of future results. Nothing in this site is intended to be a recommendation to buy or sell any futures or options market. All information has been obtained from sources, which are believed to be reliable, but accuracy and thoroughness cannot be guaranteed. Readers are solely responsible for how they use the information and for their results. SymmetryIndicators, Inc. and DayTradingTheFutures, Inc and their affiliated websites., do not guarantee the accuracy or completeness of the information or any analysis based thereon.

Margins subject to change without notice.

Commission Rule 4.41(c)(1) applies to "any publication, distribution or broadcast of any report, letter, circular, memorandum, publication, writing, advertisement or other literature…." Commission Rule 4.41(b) prohibits any person from presenting the performance of any simulated or hypothetical futures account or futures interest of a CTA, unless the presentation is accompanied by a disclosure statement. The statement describes the limitations of simulated or hypothetical futures trading as a guide to the performance that a CTA is likely to achieve in actual trading.

Additional Risk Disclosure Statement for System Traders:

Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses. There have been no promises, guarantees or warranties suggesting that any trading will result in a profit or will not result in a loss.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully account for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

E-Book continued.

Remember, the average REWARD TO RISK on my setup is 5-1. You will see profits in excess of 10-1 reward to risk with major annoucements. You will never have a stop more than 10 ticks or pips in the currency or forex and no more than 6 ticks on the S&P500 futures. How would you like a 10 point S&P500 futures trade with a 1.5 hard stop in minutes not hours? How would you like a 10 tick or pip stop in the Euro(CME) futures or the Eur/Usd with a 50-100 tick or pip gain? This setup gets you in with a 10 tick or less hard stop with a potential of a 100 tick trade. Just wait until these important economic news events come out every month. These annoucments are known weeks in advance. This setup comes up minutes after key numbers are announced. You will look for this specific setup with major economic numbers including CPI, PPI, GDP etc. all at 830am. est. and Fed Annoucments(2:15 pm est.). These monthly economic annoucements and more are all listed in my book. Every week you will be trading this specific setup after these announcements are released.

I'VE MADE IT REAL EASY FOR YOU! The forex and currency futures trade almost 24 hours a day. You will want to get your trading plan ready for the week Sunday night by viewing www.forexfactory.com and only trade my setup when a red briefcase(impact number) on the calendar is posted. They post the impact numbers a week in advance. Forex Factory is free and very useful to indicate when to trade this specific setup. How easy is that to incorporate in your day trading plan? Knowing exactly the TIME and PRICE to trade my setup. Remember, its all about the reward to risk trades. Members in my live day trading room that trade my institutional setups have one goal in mind. Great Reward to Risk. This setup gives you another weapon to use in markets everyday.

Jay

** SymmetryWedge Indicator ** Just Released **

A Leading Indicator for 'Pattern Recognition'

JUST RELEASED! An explosive chart pattern that alerts you a big move is about to occur in the futures and Forex markets. This leading indicator is a coil in the market and gives the day trader a heads up when the price range is getting tighter and that an ensuing explosive move is coming. This newly released indicator is a must see for anyone trading the Futures and Forex markets. Once plotted on the Ninja Trader Platorm, it almost always leads to an explosive move in price action. This works on all markets.

*** E-Book *** Just Released *** Explosive moves within minutes Day Trading Our Institutional Zones! Click Here

3 Day 'FREE' Trial in 'Live' Day Trading Rooms. Click Here

Come in and watch our 'Top Setups' and how we trade the 'Crude Oil' and 'Euro Currency' Futures, 23 out of 24 hours a day. See how our recent member did 370 ticks in his first week, another trader did 541 ticks trading just one of Jay's setups, 'The Triangle Squeeze', another member 160 ticks for the day, other traders 50 tick trades, just another day! Thnx for coming to work! Click here to read his statement.

Inquire About Our OtherSymmetry Indicators Available.

- Symmetry Indicators SymmetryDots = Leading Indicator Trailing Profits and Exits!

- Symmetry Indicators JayExtension = Signals Tops / Bottoms and Amazing Entries!

Leading Indicators That Work On Futures / Forex / Stocks!

Contact: Jay & Jerel at SymmetryIndicators@hotmail.com 1-954-876-1566