Please Scroll Down to see Screen Shots

Would you like to day trade with 2 leading indicators instead of lagging indicators in the futures, forex & stock markets.

- The SymmetryDots indicator allows you to focus on possible tops and bottoms far in advance. Also, the dots will allow you to focus on buying higher lows and shorting lower highs with the symmetry of the market. This allows you to catch the big moves and trail your positions with small stops and not counter trend trade. For example, if the market that you are trading is setting higher lows with dots then you want to buy pullbacks to the buy dots. If the market is setting lower highs then you want to short rallys into the sell dots. When the trend is about to change the dots will then call the highs and lows on a very consistent basis.

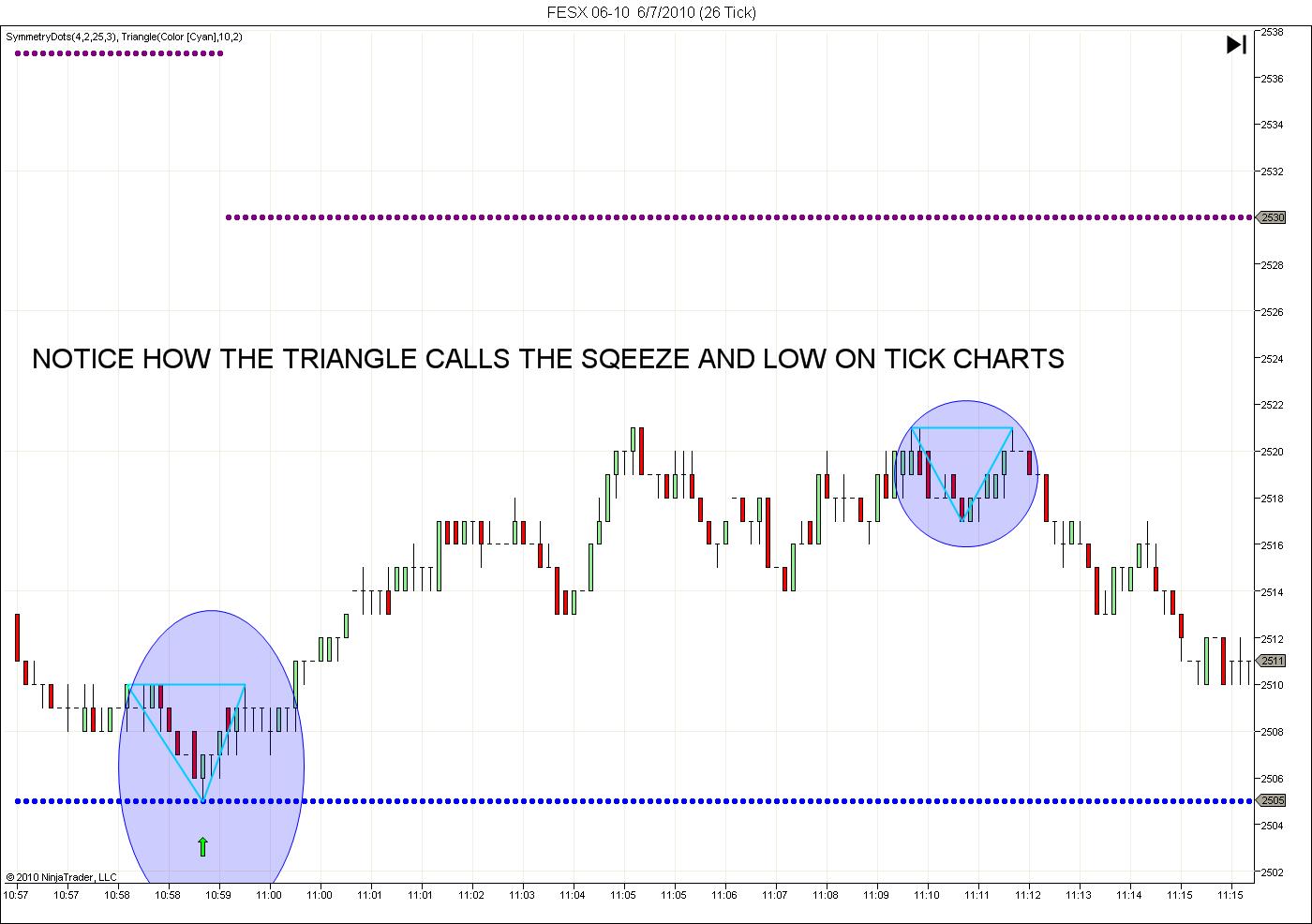

- The SymmetryTriangle indicator indicates a sqeeze play or a big vertical move is about to occur due to price action. The Triangles can call major tops and bottoms and are also great for hard trends when the markets pause (squeeze) for a continuation when in line with the symmetry dots.

- Using both together is a very powerful combination with the NinjaTrader platform. Trade what you see, not what you believe.

SymmetryIndicators.

Please Scroll Down to see more.

DAY TRADING WITH THE SYMMETRY OF THE MARKET

- E-book 'TRADING THE NEWS released! Powerful institutional setup, right at the open, everday in every market. News or no news. Be done in the first hour of trading. We give you the specific setup to the exact tick/pip. Huge 5-1 average reward to risk. See the 3 videos, how we nail it and start trading this institutional setup today.

*** E-Book *** Just Released on our top Institutional trade setup! Click Here and read more.

Sign up for a FREE 3 Day TRIAL TO OUR LIVE TRADING ROOMS CLICK HERE

- Symmetry Indicators SymmetryDots = Leading Indicator Trailing Profits and Exits!

Leading Indicators That Work On Futures / Forex / Stocks!

Inquire About Our OtherSymmetry Indicators Available.

- Symmetry Indicators JayExtension = Signals Tops / Bottoms and Amazing Entries!

** Revolutionary New Fibonacci Confluence Indicator, the SymmetryIndicators'JayExtension' Indicator **

We have all seen the accuracy of my Jay Cluster dots in my live room. The SymmetryIndicators'JayExtension' Indicator system automatically spots high probability reversal points in all markets using the top Fibonacci confluence levels traded daily by the major institutions. Your NinjaTrader compatible SymmetryIndicators'JayExtension' Indicator will automatically pop up and signal a red 'Sell' dot or blue 'Buy' dot on any time frame or market. These 'Signal Dots' are not lagging and give the trader an edge over his or her opponents. You will be able to adjust the number of Fibonacci confluence levels from at least 2 and up. The SymmetryIndicators'JayExtension' Indicator 'Signal Dots' work on the Futures, Forex and individual stocks. ** For NinjaTraderOnly

- Live Day Trading Room 23 Hours A Day

- Crude Oil and the Euro Currency Futures

*Risk Disclosure / Risk Disclaimer:

There is a risk of loss in futures, Forex and options trading. There is risk of loss trading futures, Forex and options online. Please trade with capital you can afford to lose. Past performance is not necessarily indicative of future results. Nothing in this site is intended to be a recommendation to buy or sell any futures or options market. All information has been obtained from sources, which are believed to be reliable, but accuracy and thoroughness cannot be guaranteed. Readers are solely responsible for how they use the information and for their results. SymmetryIndicators, Inc. and DayTradingTheFutures, Inc and their affiliated websites., do not guarantee the accuracy or completeness of the information or any analysis based thereon.

Margins subject to change without notice.

Commission Rule 4.41(c)(1) applies to "any publication, distribution or broadcast of any report, letter, circular, memorandum, publication, writing, advertisement or other literature…." Commission Rule 4.41(b) prohibits any person from presenting the performance of any simulated or hypothetical futures account or futures interest of a CTA, unless the presentation is accompanied by a disclosure statement. The statement describes the limitations of simulated or hypothetical futures trading as a guide to the performance that a CTA is likely to achieve in actual trading.

Additional Risk Disclosure Statement for System Traders:

Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses. There have been no promises, guarantees or warranties suggesting that any trading will result in a profit or will not result in a loss.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully account for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

(CFTC RULE 4.41) THE (JAYTRADER2.0P AND JAYTRADER2.0L) THAT CALCULATES SUGGESTED ENTRY AND EXIT POINTS CAN PRODUCE HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS WHICH HAVE CERTAIN INHERENT LIMITATIONS UNLIKE ACTUAL PERFORMANCE RECORD: SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY HAVE UNDER- OR OVERCOMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO PRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL, OR IS LIKELY TO ACHIEVE, PROFITS OR LOSSES SIMILAR TO THOSE PREDICTED OR SHOWN. HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER OR OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. SIMULATED RESULTS DO NOT NECESSARILY IMPLY FUTURE PROFITS. THE RISK OF LOSS IN TRADING FOREX OR COMMODITY CONTRACTS CAN BE SUBSTANTIAL. YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Copyright 2009. Daytrading The Futures - All Rights Reserved

Day Trading The Futures